Our Synergy

As Indonesia’s leading diversified energy company, we bring together Energy Resources, Energy Services, Energy Infrastructure, and Diversified Portfolio into a complete value chain that provides energy solutions to meet national and global needs

Energizing Indonesia

For decades, we have helped energize Indonesia’s economic growth and social development. We have lit up homes and schools, electrified small businesses and large industries, and provided jobs for thousands of Indonesians and a sense of community and purpose for countless more.

These are things that we still do and will continue to do going forward — in innovative and sustainable ways. We are proud of our contributions to Indonesia.

Our coal is an affordable, reliable and increasingly clean source of energy for supporting an emerging economy like Indonesia’s.

Our investments in renewable energy and other sustainable businesses are part of a diversification process as we transition toward a greater focus on non-coal businesses.

We are optimistic about achieving the changes that we seek. Indika Energy does not work alone. We are part of the wider Indonesian community, one that is young, ambitious, and driven by the desire to make a social impact in everything they do.

Our Vision

Highly trusted, innovative and enduring business partner for

Our Mission

- To develop Indonesia in a sustainable way

- To be a robust diversified investment company

- To empower our people and actively develop next generation leaders

- To be socially responsible, embracing diversity and acting with integrity

- To create exceptional value for all our stakeholders

Our Values

Unity in Diversity

Viewing diversity as an asset to the company and accepting, valuing, completing and strengthening one another as a solidly unified entity

Integrity

Honest with oneself, others and one’s work at every moment by upholding prevailing ethical standards and legal norms

Teamwork

Actively contributing and collaborating based on trust and shared interests rather than personal interests

Agility

Consistently demonstrating resilience and showing flexibility as well as adaptability through innovative-entrepreneurship

Achievement

Achievement as the measure of success and the motivation to do what is best for the company

Social Responsibility

Highly concerned to the environment and community, and contributing added value to the society

Our Operations

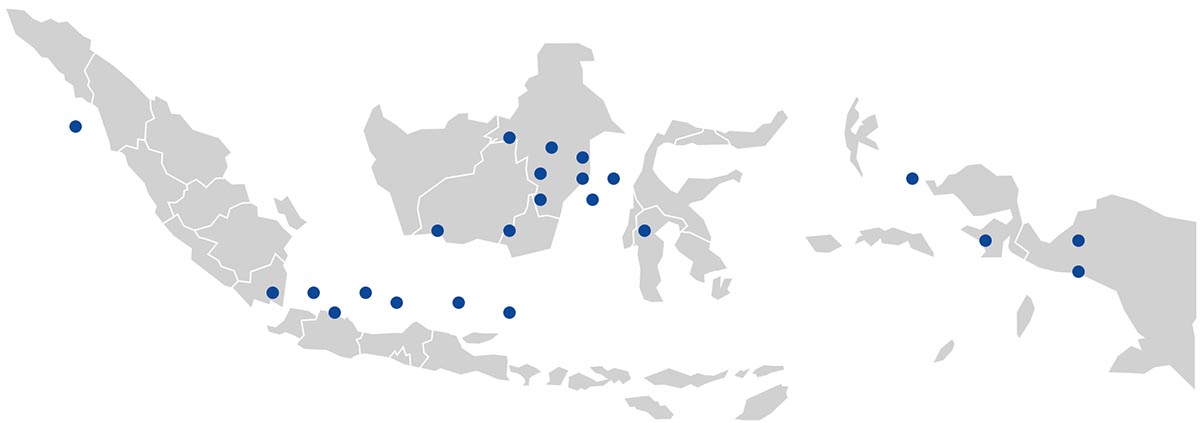

Kideco Jaya Agung, established in 1982, undertakes surface coal mining at a 50,921 hectare concession in Paser Regency, East Kalimantan, Indonesia, currently operates six mine concession sites using open pit mining methods in Roto North, Roto South, Roto South (Biu), Roto Middle, Susubang and Samarangau. Kideco produces range of sub-bituminous coal containing very low levels of sulphur (average of 0.1%) and ash (blended average of 2.1% to 4.9%), making it environmentally friendly for use in coal-fired power plants.

Paser Regency, East Kalimantan

MUTU’s mine provides bituminous thermal and coking coal under a third generation CCoW valid into 2039, based in Central Kalimantan, with a concession area of 24,970 hectares of which over 7,000 Ha have been mapped. MUTU has developed coal hauling roads with a capacity of 3.0 million tons per year and a barge port with a capacity of 5.0 million tons per year.

Palangkaraya, Central KalimantanA consortium consists of Tripatra Engineers and Constructors, Tripatra Engineering, Chiyoda International Indonesia, Saipem Indonesia, Suluh Ardhi Engineering and Chiyoda Corporation who worked on BP Tangguh onshore Front-End Engineering and Design (FEED) in Tangguh Expansion Project (Train 3).

Teluk Bintuni, West PapuaA collaboration between Saipem Indonesia, Tripatra Engineers and Constructors and Hyundai Heavy Industries for the engineering, procurement, construction and installation (EPCI) of a new Barge Floating Production Unit (FPU) for Jangkrik and Jangkrik North East Gas Field Development in Indonesia for a total amount of $1.1 billion with a delivery at site ready for SURF hook-up in 34 months.

Bontang, KalimantanPT Perusahaan Listrik Negara (PLN), appointed Tripatra to develop the mobile power plant in Nias Island, North Sumatra with an installed actual capacity of 35 MW. The project was the part of the government’s 35,000 MW acceleration program to increase electric power supply for industry, businesses, and households in North Sumatra. Tripatra provided EPC as well as 5-years Operation and Maintenance Services for the dual-fuel Gas Engine Base Power Plant facility.

Nias Island, North SumatraA joint venture (JV) between PT. AKR Corporation and Royal Vopak – PT. Jakarta Tank Terminal (JTT), appointed Tripatra to develop fuel storage terminal for its secondary phase. This Facility stored clean petroleum products which were made ready to be distributed across the country. Tripatra provided EPC service for 8 fuel storage tanks with capacity of 100,000 cbm for gasoline, ethanol and fame. The services including upgrading the Terminal Automation System (TAS), and also upgrading its Truck Loading Bay to add 24 set automated inline blending, 4 set automated unloading arm, and dye injection system for 6 arm.

Jakarta

Petrosea commenced contract operations at this project at 2011, providing overburden removal and coal production services, as well as infrastructure development, including a new workshop, office and camp accommodation. On 16 March 2018, Petrosea signed a contract amendment with Kideco to add the scope of work for a period of 5 years.

East Kalimantan

CEP is a 660 MW coal-fired power generation plant (CFPP) completed in 2012, uses low caloric coal, succeeds in keeping Nitrous Oxide emissions significantly lower than government specifications through super-critical and ultra super-critical technology, which also results in improved cycle efficiency and lower coal consumption.

Kanci Cirebon, West Java

POSB provides efficient and effective solutions for offshore oil and gas companies with its 195-meter jetty, three deep-water quays, extensive crane and material handling equipment, as well as low-cost hard stand and undercover storage facilities. POSB also features offices, workshops and international standard pollution control facilities.

East Kalimantan

Indika Logistic and Support Services provides a wide range of logistic services, including but not limited to supply chain business process solution, warehousing and inventory management, transportation, and port operation and related services. As Port Business Entity License (BUP) holder, ILSS operates and provides port and logistic related services at all Indonesia major and intermediary ports.

North Sumatra, Jakarta, East Java, South Sulawesi, Papua, Singapore

KGTE is a wholly owned indirect subsidiary of Indika Energy and engages in terminal fuel storage. On 12 April 2018, Kariangau signed a storage facility service agreement with PT ExxonMobil Lubricants Indonesia (ExxonMobil). Under the terms of the agreement Kariangau will build, own and operate a terminal to store and deliver fuel products and associated services in East Kalimantan with 96 million liters of storage capacity, for the exclusive use of ExxonMobil. The contract will be valid for 20 years, with an option for a 10-year extension and estimated project cost of US$115 million. In November 2020, the fuel storage terminal has been commercially operated.

Kariangau, East Kalimantan

Nusantara owns a 7th-generation Contract of Work (CoW) signed with the Government of Indonesia in 1998 for the Awak Mas gold project in Sulawesi. The CoW covers an area of 14,390 hectares and is held by Nusantara’s wholly% owned local subsidiary, PT Masmindo Dwi Area, and is valid through 2050. The Awak Mas gold project has potential resources of 2.0 million ounces and potential reserves of 1.1 million ounces. Indika Energy’s total direct and indirect ownership in Nusantara amounts to 27.8%.

Sulawesi- Energy

- Logistics and Infrastructure

- Minerals

- Green Business

- Digital Ventures

Our Leadership Team

Indika Energy’s leadership team is determined at the General Meeting of Shareholders (GMS), which appoints members of the Board of Commissioners and Board of Directors.

Board of Commissioners

Our Journey

1972

1973

1977

1982

1988

1990

1994

1995

2000

2004

2006

2007

2008

2009

2010

2011

2012

2013

2015

2016

2017

2018

2020

2021

2022

Petrosea (previously known as Petro-Sea International Indonesia) was established

Tripatra was established

Tripatra was renamed to Tripatra Engineering

Kideco Jaya Agung (Kideco) was established

Tripatra Engineers and Constructors was established

Petrosea got listed in Jakarta and Surabaya Stock Exchanges (now Indonesia Stock Exchange) as PTRO

Mitrabahtera Segara Sejati (MBSS) was established

Kuala Pelabuhan Indonesia (KPI) was established

Indika Energy (previously known as Dipta Diwangkara) was established

Indika Energy acquired 41% stake in Kideco

Cotrans Asia was established

Indika Energy acquired additional 5% stake in Kideco, increasing its ownership to 46%

- Indika Energy completed mergers with Tripatra Engineering and Tripatra Engineers and Constructors

- Cirebon Electric Power (CEP) was established with Indika Energy owning 20% stake

- Tripatra acquired 45% stake in Cotrans Asia

- Indika Energy went public with its initial public offering (IPO) in the Indonesia Stock Exchange for its 937,284,000 shares or 20% ownership

- Sea Bridge Shipping, a transshipment service company in which Tripatra owned 46% stake, was established

- KPI became a wholly owned subsidiary of Tripatra

- Intan Resource Indonesia, a coal trading and mining consultancy company, was established

- Indika Energy acquired 100% stake in Indika Capital Pte. Ltd. (previously Westlake Capital Pte. Ltd.) and Citra Indah Prima

Indika Energy acquired 98.55% of Petrosea

- Indika Logistic & Support Services (ILSS) was established

- Indika Energy entered into option agreement to acquire 51% stake in MBSS

Indika Energy acquired 51% stake in MBSS

- Indika Energy refloated Petrosea’s shares as much as 28.75% ownership

- Indika Energy acquired 85% stake in Multi Tambangjaya Utama (MUTU)

- Indika Energy acquired 60% stake in Mitra Energi Agung (MEA)

- CEP reached its commercial operation date (COD) and became fully operational

ILSS acquired Tripatra’s 95% ownership in KPI

- Indy Properti Indonesia (IPI) officially launched Indy Bintaro Office Park with Petrosea as its first tenant in June 2015

- Indika Energy kicked off 1000MW coal-fired power project Cirebon Energi Prasarana with 25% ownership

- Petrosea acquired 51.25% stake in Mahaka Industri Perdana

- Tripatra awarded the Tangguh LNG Train 3 Expansion Project

- The establishment of Yayasan Indika Untuk Indonesia (Indika Foundation)

- The Company and its subsidiary, PT Indika Inti Corpindo entered into separate Share Purchase Agreements with Samtan Co., Ltd. (Samtan) and PT Muji Inti Utama (Muji), respectively, to purchase 40.0% of PT Kideco Jaya Agung (Kideco)

- Establishment of PT Indika Digital Teknologi

- Establishment of PT Zebra Cross Teknologi

- Establishment of PT Xapiens Teknologi

- Indika Energy through the Indika Foundation and other parties establish Genomik Solidaritas Indonesia (GSI) lab, the biggest PCR testing laboratory facility in Indonesia with biosafety level 2 certification

- Indika Energy conducts a buyback of 7.5 million shares at an average price of IDR 692.99 per share. Indika Energy issues a new senior note in aggregate amount of $675 million with five-year tenor extending the bonds matured in 2022 and 2023 to 2025

- Indika Energy conducts consent solicitation and obtains 85.9% consent from 2024 bondholders to align the 2024 bond covenants with the new bond

- Indika Energy through Indika Mineral Investindo adds 25% shares of PT Masmindo Dwi Area, a project company of Awak Mas Gold Project

- Interport completes the construction and commences operation of its fuel storage facility in Kariangau, East Kalimantan. Indika Energy Group obtains ISO37001 Anti-Bribery Management System certification

- The Ministry of Transport appoints the Patimban Consortium to operate Patimban Port. Indika Logistic and Support Service has a 29% interest in the consortium

- Indika Energy established a joint venture company with Fourth Partner Energy, under the name of Empat Mitra Indika Tenaga Surya (EMITS)

- Establishment of Electra Mobilitas Indonesia (EMI)

- Indika Energy entered a binding Scheme Implementation Deed with Nusantara Resources Limited (NUS) with regards to the intention of the Company to acquire all of the issued shares of NUS

- Through PT Jaya Bumi Paser, DBS Bank Indonesia supports Indika Energy’s energy transition, through funding facility worth US$27.5 million

- On May 27th, Indika Energy announced its collaboration with Alpha JWC Ventures and Horizons Ventures in the form of joint investment in Ilectra Motor Group (IMG), a company that specializes in electric two-wheel vehicles

- On July 28th, Indika Energy has completed the sale of all its 704,014,200 (or 69.8%) shares in PT Petrosea Tbk to PT Caraka Reksa Optima